FXStreet.com

What do Candlesticks Look Like?

Candlestick charts are much more visually appealing than a standard two-dimensional bar chart. As in a standard bar chart, there are four elements necessary to construct a candlestick chart, the OPEN, HIGH, LOW and CLOSING price for a given time period. Below are examples of candlesticks and a definition for each candlestick component:

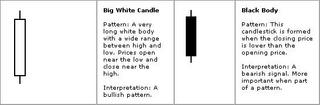

The body of the candlestick is called the real body, and represents the range between the open and closing prices.

The body of the candlestick is called the real body, and represents the range between the open and closing prices.A black or filled-in body represents that the close during that time period was lower than the open, (normally considered bearish) and when the body is open or white, that means the close was higher than the open (normally bullish).

The thin vertical line above and/or below the real body is called the upper/lower shadow, representing the high/low price extremes for the period (one period of time measures the duration of selling or buying within the market). As a trader, you can use any time period you want, time intervals may be a tick chart, 1 min, 5min, 10 min, 1 hour, 4 hour, 1 day,…

Glossary of Forex Terms

0 Comments:

Post a Comment

<< Home